get in touch

00

TECS

Improving government budget without introducing new taxes

Tax Enforcement Control System

Improved tax collection. Reduced grey economy. Control and management of all cash and non-cash based payments. TECS is an integrated solution tax authorities use for income under-reporting and deduction over-reporting.

BENEFITS

Quick ROI

With more efficient tax collection, government revenues increase, enabling a quick ROI.

Efficiency

The implementation of TECS enables a more efficient tax audit, making it easy to identify and perform tax inspection.

Transparency

Raising awareness of the necessity of paying taxes makes it possible to create a transparent and uniformed approach.

Positive Publicity

Creating transparency in the tax system and increasing efficiency results in an increasingly positive public image of the Ministry of Finance.

Fair Competition

Development of IT service providers - TECS solution ensures fair competition.

TECHNOLOGY Vs. GREY ECONOMY

Tax authorities around the world are seeing two particular types of tax evasion: under-reporting of income through electronic sales suppression and over-reporting of deductions through false invoicing. Tax evasion and fraud can be further facilitated by the cash economy and the sharing (or online) economy. In the past, it was difficult and time consuming for tax authorities to detect these issues. Today, many tax authorities are using technology solutions to detect these tax offenses.

TAX SYSTEM TRANSFORMATION PLATFORM

As an integrated solution, TECS solves both the problem of under-reporting of income, which is mostly present in cash-based transactions (B2C) and over-reporting of deductions, which is an issue for B2B transactions.

TECS gathers information and data on each cash transaction issued through ERP systems, POS cash machines or other terminals in real time. It enables easy identification of VAT and similar tax obligations (e.g. consumption tax) related to the invoices issued by individual taxpayers.

It relies on open technology standards for integration to existing legacy systems, central tax system and other eGovernment systems. It ensures real time reporting on all transactions with capability to identify individual items on invoices.

The platform can be implemented in a single industry, or across the entire economy. There are several deployment options available. TECS can be used as on-premise or as a cloud managed service (both private and public cloud). It can also be deployed as a hybrid solution with all the benefits of both alternatives.

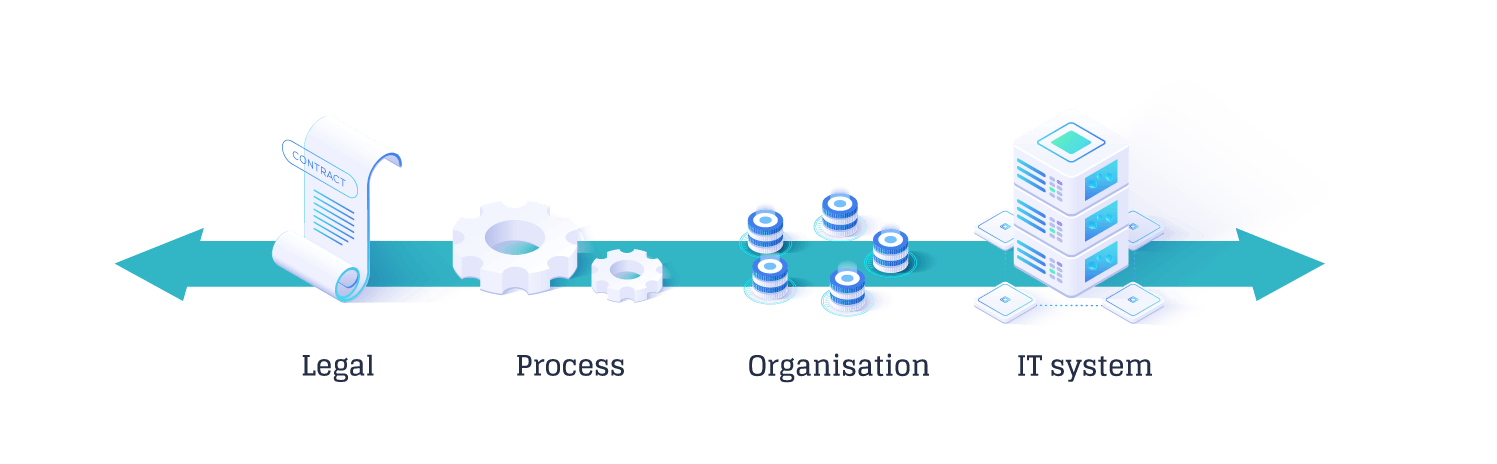

Benefit from our consulting expertise to facilitate the adoption of the legal framework, modify the tax inspection processes and make changes to your organisation. All of this relies on the IT solution we provide.

CLICK TO SEE ALL MODULES EXPLAINED –>

CONTACT US