get in touch

TECS

Tax Enforcement Control System

MODULES

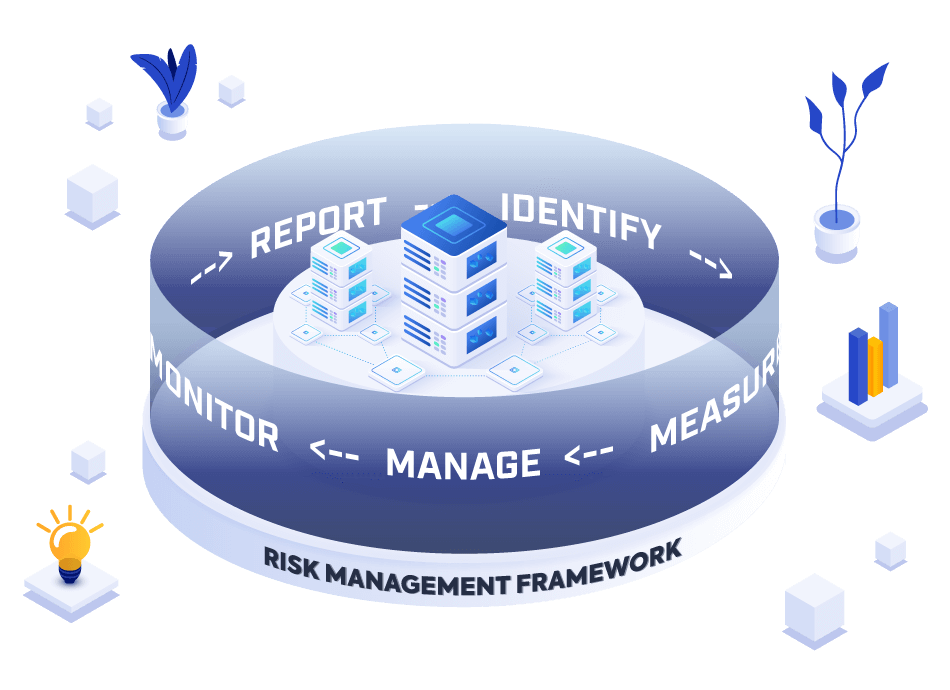

RISK MANAGEMENT

Monitor trends by analysing data in table and graph presentations. Have a clear overview of the number of invoices, amount of VAT, number of tax audits and taxpayer turnover with Taxpayer analysis.

Search for a taxpayer by business activity, location, name or tax number, and perform calculations of deviation, average values and minimum or maximum of various KPIs.

Compare turnover among taxpayers in a similar area and view audits for a taxpayer or their branch in a list. TECS will automatically send notifications to taxpayers with significant deviations for defined KPIs.

Manage anomalies by identifying discrepancies in issued invoices and reviewing unexpected statistical deviations of turnover for a taxpayer. The list of invoices detected by anomaly management will be send to the taxpayer.

TAX AUDIT

Tax audit is a lawful action aimed to determine if the appropriate taxes are fully paid.

Planning

Suggest taxpayers for audit according to the risk analysis and timeframe of taxpayer activity. Redistributes inspectors among regions and enables tracking of Human Resources.

Orders

Enables scheduling an audit procedure for a taxpayer and optimised assigning of inspectors to orders.

Notifications

Sends notifications of audit to taxpayers. Contains a repository of all notifications (electronic and by letter) for all audits. Enables printing notifications or exporting them to PDF.

Minutes

Includes the workflow and status of audit procedure, and stores document facts, evidences found and actions done during the audit procedure.

ADVANCED ANALYTICS

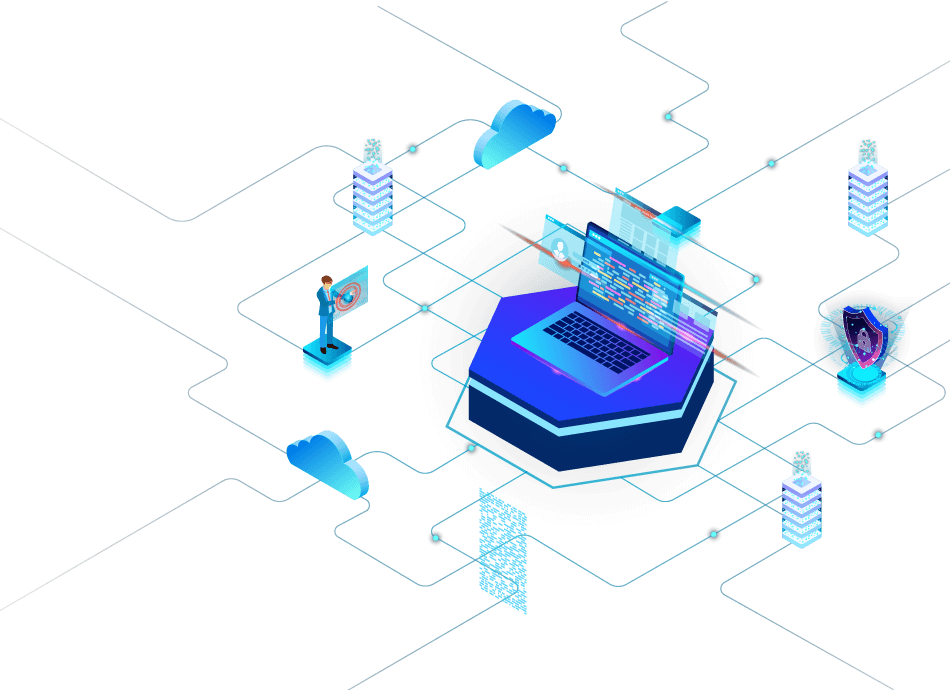

A full stack of supervisory, planning and support analytics and reporting capabilities:

– E-Oversight, Risk Analysis, Audit and Management – taxpayers’ oversight process reporting, risk identification, anomalies and trend analysis, etc.

– Spatial analysis of taxpayers – taxpayer zone geolocation, analysis of anomalies, oversight process preparation and support, etc.

– Payment trends in time periods, geography, categories, industries, etc.

– Consumption trends of specific goods or services (time periods, geography, categories, industries, etc.)

– Statistical Reports – statistics about taxpayers, invoices in period, comparative analysis, turnovers, business premises reports, tax types, etc.

– Anti-Money laundering analysis – tracking and identification of significant KPIs

– Ministry of Finance reporting – Various macro-economic statistics (industry turnover, debt statistics, payment statistics etc.

– Business Premises Register reports, manufacturers and maintainers of software payment devices, etc.

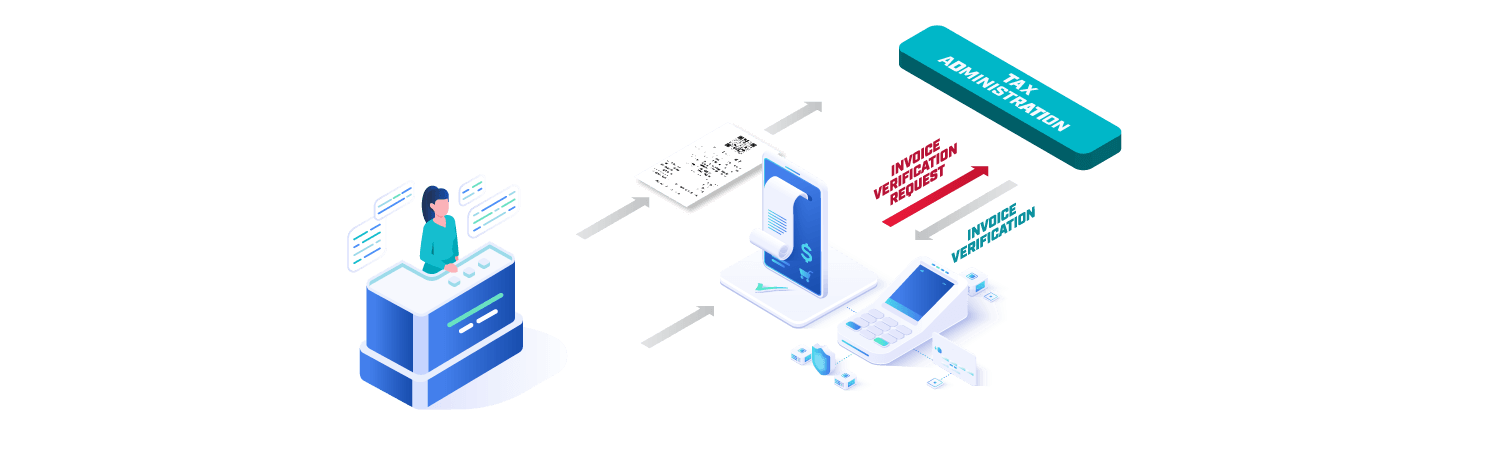

TRANSACTION FLOW

Taxpayer systems (ERP, POS, ECR, etc.) communicate the required invoice content to the TECS system in real time. Once the invoice content is verified by TECS, the taxpayer system receives a Unique Invoice Identifier and can print the invoice or send it in an electronic form. All invoices reported to TECS are digitally signed. The PKI can be deployed as part of the project, or we can adjust the deployment with the use of existing PKI infrastructure.

MODULES

Fiscalization services (FIS) - B2C, B2B, B2G | Real-time operation service | Offline operation module | Collecting of system operation KPIs and statistics | Monitoring of system functionalities

Internal portal | Tax collection overview | Tax payer administration | Tax payer registry (RTP) administration | Tax payer supervision | Critical tax payer detection | Operational reports | Overview of registered cash payment irregularities (received by citizens) | Tracking of portal usage

e-Invoice platform/hub | Service provider and Access Point | Front-end for eBilling for small business | Management of the entire business process of issuing, transferring and receiving invoices and attachments and their secure archiving | Fast, safe and simple sending, receiving and saving invoices, and forwarding for payment | Automatic generation of payment orders based on received invoices | Bank integration - pairing of eInvoices with bank payments and tracing payment state (paid, not paid) | Data structure ready for further electronic processing | Electronic invoice signing | Complies with EU laws and standards, in accordance with x.509v3, UBL 2.1 standard, CEN and IDABC recommendations

Central Portal add-in | 360 degree view of taxpayer assets (business, including private person and relatives) | Central Real Estate Register | Taxation database (real estate status, property description, property condition, etc.) | Central Register of Movable Property | Central Register of Intangible Assets | Central Register of Financial Assets | Central Tax Registry of Certified Property Appraisers | Transaction tracking | Contract conclusion and tracking | WEB services for update/validate other institutions data responsible for monitoring market capital | Historical overview of taxpayer assets | Taxpayers RTP card | Historical overview of taxpayer assets | Source for property purchase tracking

Central Portal add-in | Risk calculation and detection/ranking of taxpayers | Support for complex risk types - Statement (Simplified, Frequency, Deviation), Correlation and Anomaly | Dashboards with results analysis | Risk catalogue - Definition and administration of risks | Simulation sandbox for risk scenarios (unlimited catalogues) | Risk treatment definition | Risk evaluation | Register of tax irregularities

Central Portal add-in | Taxpayer analysis based on diverse parameters | Trends monitoring | Online and field audit | Inspection planning and support | Execution tracking and statistics | Audit case management | Anomaly detection and management | Multi-channel taxpayer notifications | Mobile module for inspectors (responsive web application)

Tax payment analysis | Tax collection analysis | Geospatial analysis | Risk analysis and prediction | Tax Authority employee analysis | Tax Authority operation analysis

External self-care portal | Invoice verification by QR code | Taxpayer register (RTP) card access | Tax balance check (Debt/Prepayment) | Invoices overview (issued/received/error etc.) | Self-registration of branches, POS devices, employees etc.

External responsive web application | Usable on all devices - smartphone, tablet, computer | No installation | Streamlined and user friendly

CONTACT US